Principals of Thai Law

- A loan contract is a contract in which a lender transfers a sum of money to a borrower and the borrower agrees to return such sum of money to the lender.

- A loan amount of more than 2,000 baht is not enforceable by action unless there is some written evidence of the loan agreement signed by the borrower. Repayment of a loan amount may not be proved absent evidence in writing signed by the lender or other documentary evidence that the loan has been surrendered to the borrower or otherwise cancelled.

- Interest shall not exceed 15% per year; when a higher rate of interest is fixed by the contract, it shall be reduced to 15% per year.

- Interest shall not bear interest. The parties to a loan contract may however, agree that the interest due for not less than one year shall be added to the capital, and that the whole shall bear interest but such agreement must be made in writing.

- Commercial usage for the calculation of compound interest in current accounts, as well as in other similar commercial transactions, is not governed by the foregoing paragraph.

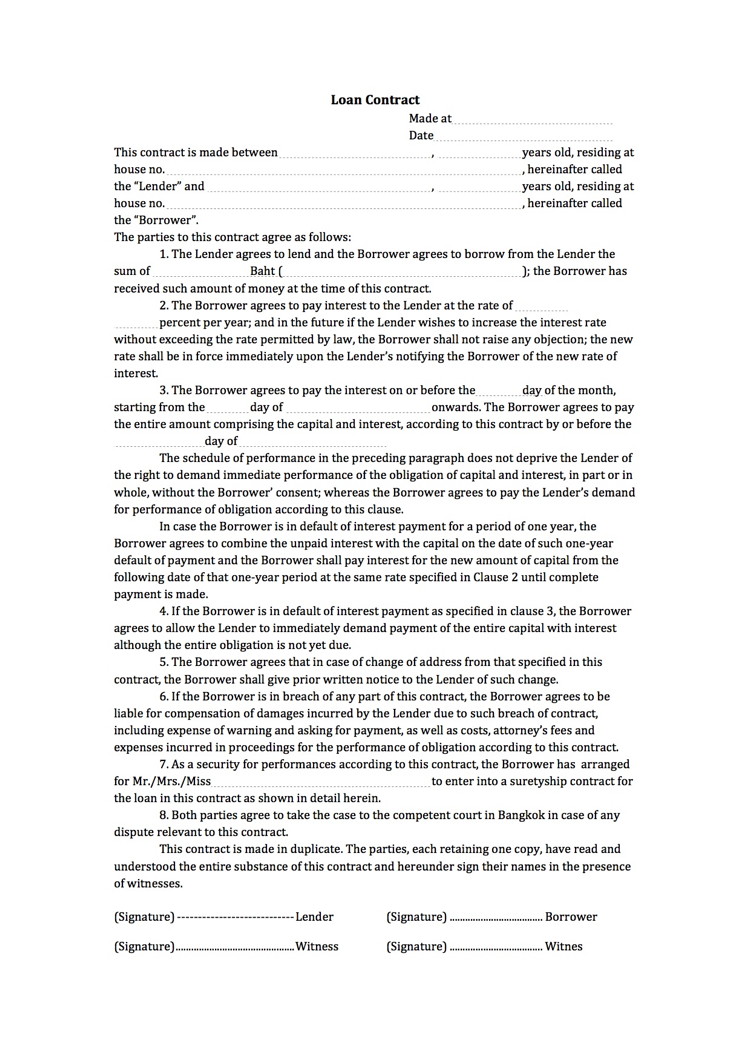

Sample Loan Contract Which Complies With Thai Law